Eastmont Community Center provides IRS-certified tax services for the community of East Los Angeles that qualifies within the Los Angeles County 1st Supervisorial District.

Electronic filing of tax returns year-round at its center.

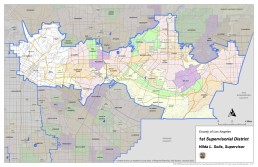

1st Supervisorial District 2022 Map

Call to make tax appointments:

(323) 726-7998

Important documents to bring for tax appointment:

- All taxpayers must present with photo identification

- Social Security cards or Individual Tax Identification Number (ITIN) letter for all people listed on return

- Birthdates for all the people listed on return

- All income statements, such as Forms W-2 and 1099, Social Security and unemployment compensation, other statements such as pensions, stocks, interest, and any documents showing taxes withheld and self-employed income and expenses less than $10,000

- All records of other expenses such as tuition, student loan interest, mortgage interest, or real estate taxes on Form 1098

- If purchased insurance coverage through Covered California, forms CA 3895 and 1095-A, Health Insurance Marketplace Statement

- Bank routing numbers and account numbers to direct deposit refund

We are unable to assist taxpayers who fall into one or more of the following categories:

- Incomes more than $57,000

- Married Filing Separately returns (If you are legally married & file alone)

- Self-employed or cash income with business related expenses over $10,000, have a loss, taking expenses with no proof (receipts, documented mileage, etc. are required), employees, inventory or business property.

- Returns for businesses (S-Corps, LLCs, etc)

- Cancelled debt income (Forms 1099C and 1099A) for foreclosures or short sale

- Handwritten tax documents (W-2, 1099, 1098, etc.)

- Returns for visitors, such as “F,” “J,” “M,” or “Q” visas, which require a 1040NR tax return

- Foreign Income, Royalty Income, or income from a partnership/corporation (K-1 form)

** REQUIRED: All taxpayers will need to present valid photo identification and original social security cards/ITINS for all household members that will be included in the tax return.

Have Questions? Contact:

Elizabeth Cervantes

(323) 312-5391

ecervantes@eastmontcommunitycenter.org

Outside of our area or just want to file online?

Click the button below for additional resources to help you file your taxes at no cost to you.

Additional Resources