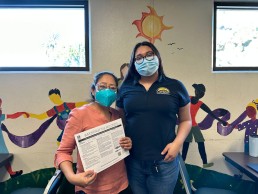

Volunteer Income Tax Assistance (VITA) provides access for IRS-Certified tax return preparations to individuals with low to moderate incomes.

The purpose of this program is to increase and maximize the amount of refunds and tax credits back to people who earn a lower income.

Eastmont Community Center offers electronic filing of tax returns year-round at its center.

Eastmont Community Center gave back to families in total tax year 2022

$428,202

Federal and State Earned Income Tax Credit (EITC)

Eastmont informed taxpayers about the importance of earned income credit to low-income working families and single households that can qualify and claim their credits. Taxpayers expressed that the extra funds will be utilized for childcare, financial and food needs.

Learn more about each of our services: VITA (Volunteer Income Tax Assistance), Financial Coaching, and Financial Education Workshops

Have Questions? Contact:

Elizabeth Cervantes

(323) 312-5391

ecervantes@eastmontcommunitycenter.org