Eastmont Community Center offers free tax help thru our Volunteer Tax Assistance (VITA) Program. IRS-certified volunteers provide free basic income tax return preparation with electronic filing to qualified individuals.

Schedule:

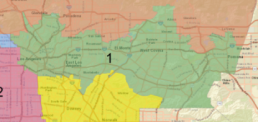

Tax Services are by appointment only- Click here and complete questionnaire and a Tax representative will get back to you if you live within our service area.

If you have any additional questions and would like to speak to a Tax representative, you may call:

Contact:

(800) 590-8749

Monday-Wednesday 8:30 a.m.- 3:30 p.m.

Monday’s drop off option is available as well

We are unable to assist taxpayers who fall into one or more of the following categories:

- Incomes more than $57,000

- Married Filing Separately returns (If you are legally married & file alone)

- Self-employed or cash income with business related expenses over $10,000, have a loss, taking expenses with no proof (receipts, documented mileage, etc. are required), employees, inventory or business property.

- Returns for businesses (S-Corps, LLCs, etc)

- Cancelled debt income (Forms 1099C and 1099A) for foreclosures or short sale

- Handwritten tax documents (W-2, 1099, 1098, etc.)

- Returns for visitors, such as “F,” “J,” “M,” or “Q” visas, which require a 1040NR tax return

- Foreign Income, Royalty Income, or income from a partnership/corporation (K-1 form)

** REQUIRED: All taxpayers will need to present valid photo identification and original social security cards/ITINS for all household members that will be included in the tax return.

Outside of our area or just want to file online?

Click the button below for additional resources to help you file your taxes at no cost to you.

Additional Resources